jersey city property tax calculator

11 rows City of Jersey City. See Results in Minutes.

If you live in Jersey and need help upgrading call the States of Jersey web team on 440099.

. This calculator will help you understand the basics of how tax works. Enter Your Salary and the Jersey Salary Calculator will automatically produce a salary after tax illustration for you simple. Unsure Of The Value Of Your Property.

Revenue Jersey Taxes Office postal address. Revenue Jersey PO Box 56 St Helier Jersey JE4 8PF. In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107.

Use this calculator to estimate your NJ property tax bill. Jersey City New Jersey 07302. In New York City property tax rates are actually fairly low.

City of Jersey City. Jersey City Property Taxes Range Jersey City Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent informed about your property bill showing a higher rate than is. Property Tax Calculator - Estimate Any Homes Property Tax.

The median property tax on a 29410000 house is 308805 in the United. For comparison the median home value in Jersey County is 11820000. To process click on Submit Search.

The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. By Mail - Check or money order to.

The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs. For comparison the median home value in New Jersey is. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out from your.

Ad Just Enter your Zip for Property Values By Address in Your Area. Free Comprehensive Details on Homes Property Near You. Below 100 means cheaper than the.

Ad Enter Any Address Receive a Comprehensive Property Report. New Jersey Property Tax Calculator How Are NJ Property Taxes Calculated. Expert Results for Free.

It doesnt send any information to Revenue Jersey or make changes to your records with us. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jersey County Tax. A towns general tax rate is calculated by dividing the total amount needed to be raised by the total assessed value of all its taxable property.

Federal income taxes are also withheld from each of your paychecks. The median property tax on a 29410000 house is 308805 in the United States. The calculator makes standard assumptions to estimate your tax and long-term care.

The average effective property tax rate in New Jersey is 242 compared to. How Your New Jersey Paycheck Works. The results you see are based on this years allowances 2022.

The average effective property tax rate in New Jersey is 242 compared to. Our New Jersey Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in New Jersey and across the entire United States. The minimum combined 2022 sales tax rate for Jersey City New Jersey is.

Under Tax Records Search select Hudson County and Jersey City. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Find All The Record Information You Need Here.

Use this calculator to estimate your NJ property tax bill. Left click on Records Search. Select Advanced and enter your age to alter age related tax allowances and deductions for your earning in Jersey.

189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Online Inquiry Payment. Online Inquiry Payment.

Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Under Search Criteria type in either property location owners name or block lot identifiers.

TO VIEW PROPERTY TAX ASSESSMENTS. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. New Jersey Property Taxes Go To Different State 657900 Avg.

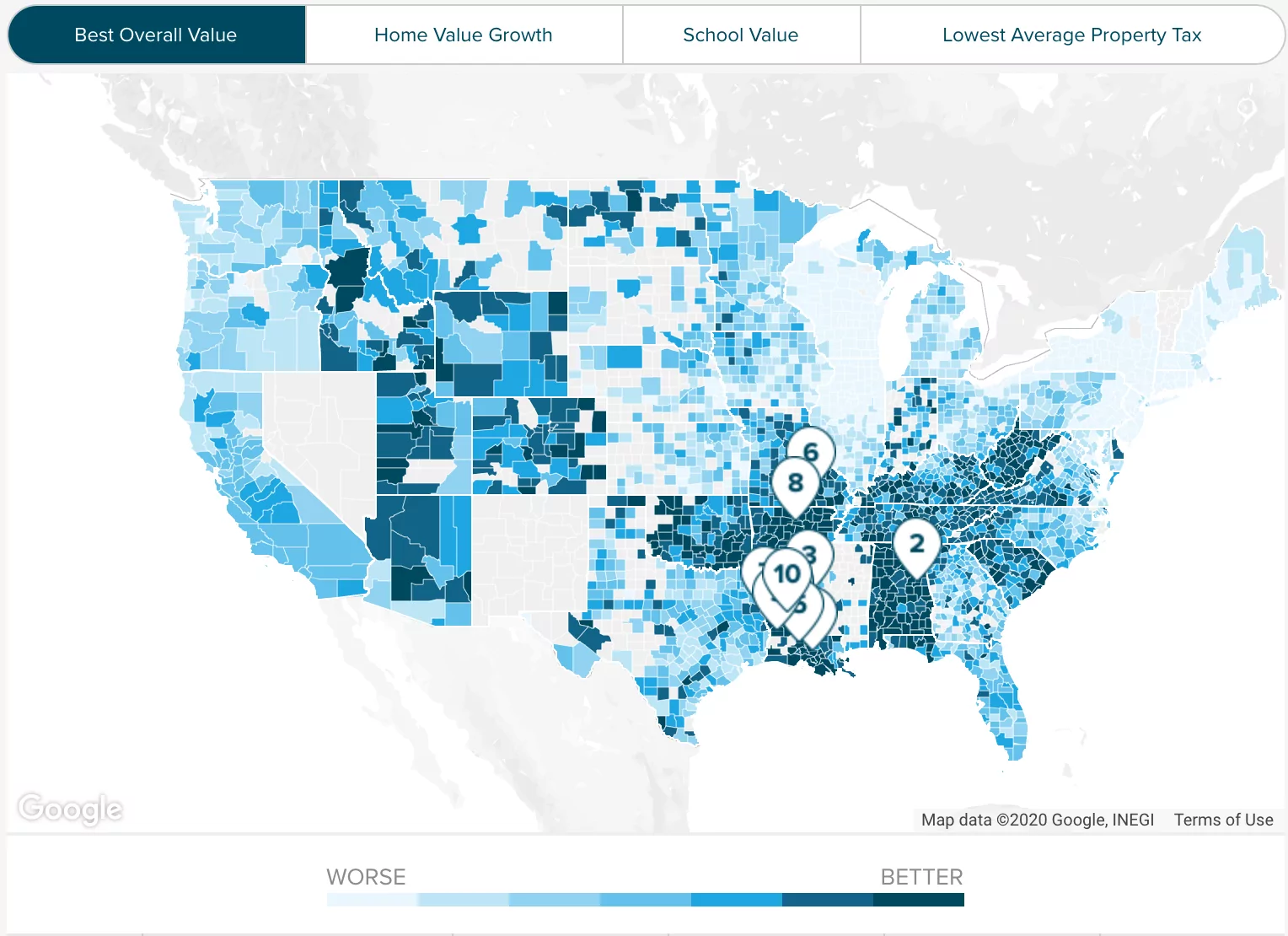

New York Property Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

2022 Property Taxes By State Report Propertyshark

The Outstanding Printable Home Inspection Report Template Elegant 2018 Home Intended For Property Management Inspectio Report Template Best Templates Templates

Pin By Tu On Buildings House Exterior Home Design Software Free Home Design Software

U S Property Taxes Comparing Residential And Commercial Rates Across States

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Tax Bill Breakdown City Of Woodbury

Nyc Home Prices Plunge After Salt Deductions Capped

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Riverside County Ca Property Tax Calculator Smartasset

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation